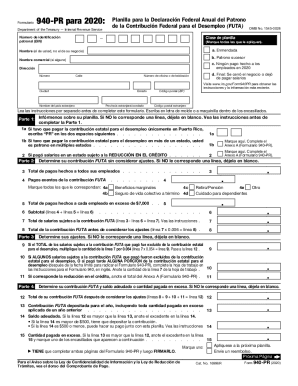

Form 940 shows the amount of federal unemployment taxes the employer owed the previous year, how much has already been paid, and the outstanding balance. The form is due January 31, or February 10 for businesses that have already deposited their unemployment taxes in full.īusinesses with employees are responsible for paying unemployment taxes. These taxes fund unemployment benefits for people who lose their jobs. A Windows version of CheckMark Payroll debuted in 1994, and MultiLedger for Windows. Unlike other taxes, these taxes are not withheld from employees’ wages. Form 1099-B, 1099-S, and 1099-MISC (with data in boxes 8 or 10) are due to the recipients by February 15. The employer alone is responsible for paying unemployment taxes and reporting them on IRS Form 940. Small business owners often find this form confusing. This is because, along with the federal government, states levy unemployment taxes through the State Unemployment Tax Act (SUTA). State unemployment taxes affect your federal tax liability, so you have to understand both FUTA and SUTA pretty well in order to file Form 940.

#940 wrong year on form checkmark payroll how to#

Read on to understand how to fill out each part of the form, as well as when to file it and how to pay your taxes.

#Wrong year in form 940 checkmark payroll how to#

As a small business owner, you might not like thinking about taxes, but understanding your responsibilities will help you stay in the clear with the IRS and keep more of your hard-earned profits. IRS Form 940 is used to report unemployment taxes that employers pay to the federal government under the Federal Unemployment Tax Act (FUTA). See What's New Experience CheckMark Payroll Software Here Is What Our Customers Have to Say Excellent CheckMark Payroll We are always pleased with the ease of use of the CheckMark platform. #Wrong year in form 940 checkmark payroll how to#įUTA taxes are used to fund unemployment benefits for people who are laid off or lose their jobs through no fault of their own. You can prepare, print or E-File Form 941 to the IRS using the latest 2023 version of CheckMark payroll software. CheckMark Payroll 23.0: Updated W2 forms, 940, 941, 943 & 9 tax filings.

0 kommentar(er)

0 kommentar(er)